- Products

- Pricing

- Solutions

- Partners

- About US

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies and merchants that accept, process, store, or transmit credit cards and credit card information maintain a secure environment. PCI Data Security Standard is required for vendors and merchants to accept card payment from customers and act as credit card processors.

Bright Pattern’s call center software is fully PCI compliant, and is designed to be a PCI call center software. Bright Pattern’s contact center software has many features, such as advanced encryption of data transfers, secure data storage of payment information, and regular evaluations of the platform to update the call center platform to meet new security standards. Bright Pattern also employs access restrictions and malware protection to further secure the PCI contact center software from unauthorized access.

Ensure the call center software is updated with new PCI standards

Encryption of information during communication

Proactive monitoring for security breaches and updates

Encryption and secure data transmission

Regular vulnerability assessments and scanning of security infrastructure for risk detection.

Rescanning of high-risk vulnerabilities based on the Common Vulnerability Scoring System (CVSS) for data breach prevention.

Key management to prevent any unauthorized access or data breach. Data is available for decryption when needed.

Connect and interact with clients seamlessly on any channel while keeping data like cardholder information and credit card information safe.

Connect and interact with clients seamlessly on any channel while keeping sensitive data, like cardholder information and card numbers, safe.

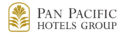

Integrate with any major CRM, like Dynamics 365, Salesforce, and ServiceNow. Or, integrate with your own CRM.

Improve efficiency and ROI in the help desk with powerful IT service management call center software.

Full compliance and comprehensive security features that ensure patient privacy while delivering great customer experience.

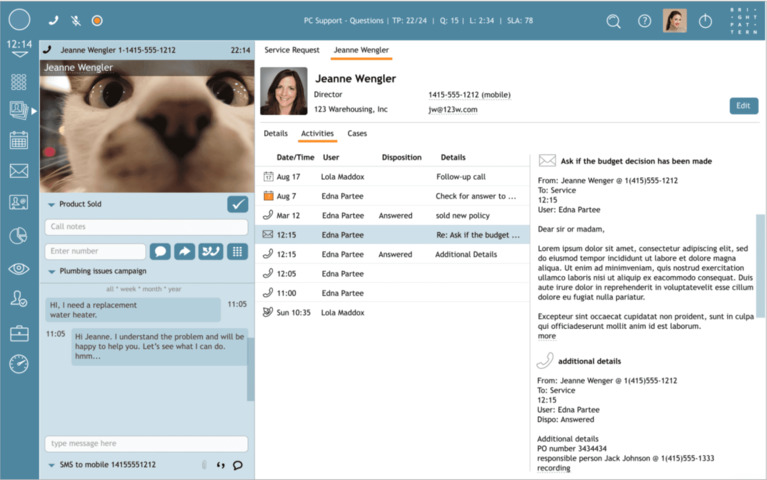

Deliver seamless, personalized interactions to customers with AI-driven contact center software. Featuring built-in quality management.

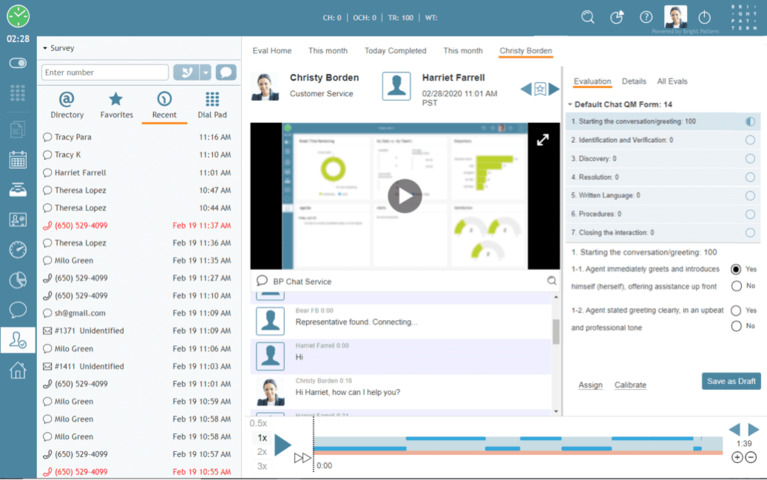

Our omnichannel contact center solution gives your organization the ability to seamlessly communicate with clients throughout their entire customer journey.

Ensure consistently excellent customer experiences and optimize call center performance with AI-powered OmniQM.

Track the customer journey with your business on any channel. Integrations with all CRM providers or your own system of records.

The Payment Card Industry Security Standards Council (PCI SSC) was founded in 2006 by the major payment card brands and major credit card companies (Visa, MasterCard, American Express, Discover, etc.) to manage the evolution of Payment Card Industry (PCI) security standards and PCI DSS compliance.

The council of these payment brands sets the PCI security standards and the PCI DSS requirements that need to be followed by any payment processor. PCI DSS compliance applies to any organization and service provider, regardless of size or number of transactions, that accepts, transmits, or stores any cardholder data and credit cards. The PCI Security Standards Council’s official documentation of current PCI DSS regulations can be found on their website here.

When merchants and businesses interact with customers, tons of sensitive information and customer data is being passed back and forth. This includes sensitive payment card information and payment card data, which includes information like payment card numbers, expiration dates, and CVV codes. Keeping sensitive credit card data and credit card transactions secure during interactions between the caller and the customer service representative should be a top priority for any merchant. Compliance requirements, security requirements, best practices, and legal requirements set by PCI means that your contact center platform should provide data security and be QSA approved.

Bright Pattern’s omnichannel contact center solution keeps sensitive cardholder data safe at a merchant level and will boost customer confidence at a consumer level. Process credit card payments safely in a secure network that follows the PCI standard at no additional cost. Bright Pattern’s solution follows the data security standard, has PCI certification, and can easily make your call center become a compliant call center. Give your customers peace of mind by keeping their personal data safe.

Bright Pattern is one of the leading vendors for AI-driven omnichannel contact center software. Our contact center software is true omnichannel, allowing you to seamlessly connect with customers over any channel. Bright Pattern has the fastest ROI and the best ease-of-use in the industry.

True omnichannel is the ability to interact with clients over any channel and seamlessly switch between channels. Start a conversation with a client over the phone, then switch over to text/SMS, then switch over to email, all while maintaining the context of the conversation. Bright Pattern supports all digital channels, like SMS, text messaging, video call, voice call, email, messaging apps, and more.

Yes! Bright Pattern is fully compliant with all major laws and regulations. Bright Pattern is fully HIPAA compliant, TCPA compliant, GDPR compliant, SOC compliant, and PCI compliant. Read about our other compliances in our compliance page.

Bright Pattern’s contact center software is flexible, dynamic, and cloud-based. Bright Pattern’s contact center solution can be tailored to any industry and any situation. Request a demo and see how we can tailor Bright Pattern’s solution to your industry.